Discover current video streaming trends, consumer behaviors, and competition amongst AVOD, SVOD and FAST services to uncover what might come next in the video streaming battleground.

Consumer Streaming Adoption and Behavior

Viewer Streaming Adoption

- Streaming subscriptions rose 20.7% from $7.7 in Q3 2022 to $9.3 billion in Q3 2023. (Digital Entertainment Group (DEG))

- Across 22 major providers, there are more than 1,500 FAST channels providing content to over 190 million users. (tubi + FOX, 2023)

- Between January and October 2023, the top 20 streaming platforms, on average, experienced a subscriber loss of 8% and a gain in 8% in per month, realizing an average net growth of zero in the U.S. (Magid – December 2023)

- The top 20 streaming networks remained steady with a churn rate at 47%. (Parks Associates, 2023)

- The average home now subscribes to 4 streaming services and watches 4.2. (MoffettNathanson Research)

- 72% of consumers feel there are too many subscriptions (Hub Entertainment Research: Aggregation Study)

- Six out of seven (86%) U.S. households have at least one streaming video service from fifteen top subscription Video On-Demand and direct-to-consumer (DTC) services. (Leichtman Research Group, 2023).

- Half (50%) of households have four or more DTC streaming video services. (Leichtman Research Group, 2023)

- The average consumer subscribes to 2.8 streaming TV services and 10% pay for more than five streaming services simultaneously. (Forbes Home, 2023)

- Average DTC Streaming Services by Age (Leichtman Research Group, 2023)

- A18-44: 4.8

- A45-54: 4.0

- A55+: 2.5

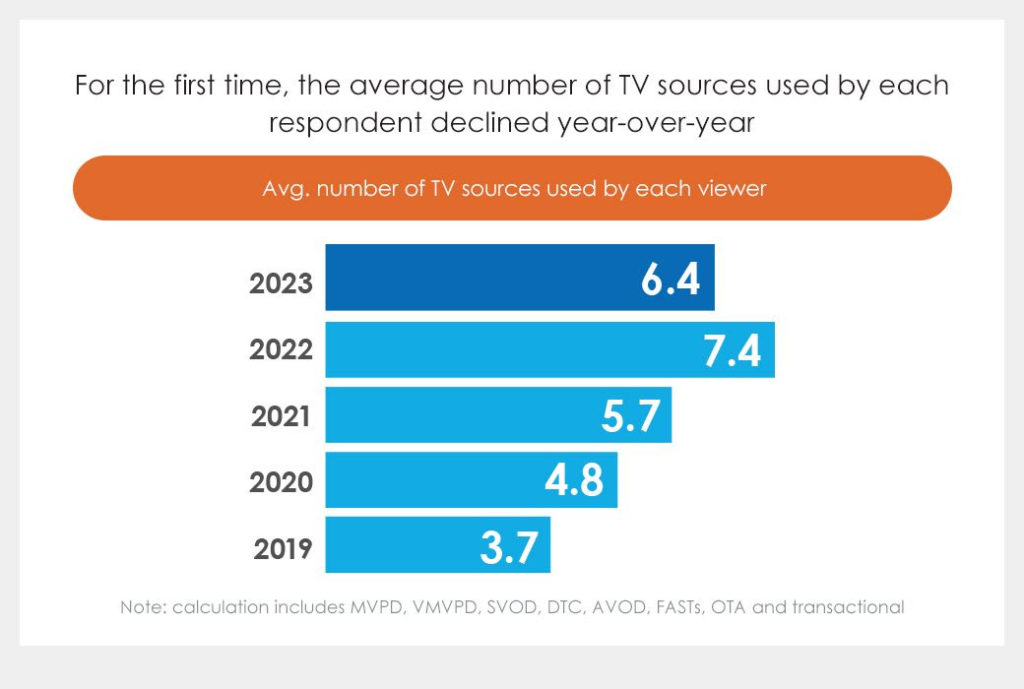

- The average TV content viewer uses about 7 services a month. (Horowitz Research)

- Netflix was the most popular streaming service with 52% subscribing followed by Amazon Prime (10%), HBO Max (7%), Apple TV (7%) and YouTube TV (7%). (Forbes Home, 2023)

- Streaming reached a record 40.3% share of U.S. viewing in June 2024. (Nielsen)

- YouTube led individual streaming services with 9.9%.

- Free ad-supported TV channels Pluto TV, the Roku Channel and Tubi accounted for 4.3% of streaming.

- They beat the Peacock, Max and Paramount+ total of 3.7%.

eSports, Gaming and Live Streaming Market

- The live-streaming segment accounts for 63% of the video-streaming market. (Global News Wire, Maximize Market Research)

- The global live-stream market is expected to reach $252.76 billion by 2029. (Global News Wire, Maximize Market Research)

- The gaming live stream market is expected to grow at a rate of 9.28% between 2023 and 2028, resulting in a projected market volume of $18.22 billion. (Statista)

- Live-stream gaming and eSports are the most-watched categories, with 54% viewership followed by music, sports, and entertainment (17%), professional content (9%), and IRL (6%). (Demand Sage, December 2023)

- Live-stream gaming and eSports sectors are projected to surpass 900 million viewers in 2024. (Statista)

- Globally, there are 3 billion video game players, and 2.8 billion of them play online. (Statista)

- Online gaming makes up most of the gaming industry as 60% of gamers play games on their smartphones. (Demand Sage, December 2023)

- Mobile gaming stands as the largest and most rapidly expanding segment in the video game industry, with revenue anticipated to soar to $218.7 billion in 2024. (Demand Sage, December 2023)

- 82% of consumers prefer to engage with a brand on a live stream rather than through social media posts. (LiveStream)

- Over one-third (35%) of marketers use live videos to market their products with 28% of marketers investing more in live streaming. (go-globe)

- Over six out of ten (63%) marketers plan to increase their use of live videos in the future. (TechJury, Statista, Forbes and Content Marketing Institute)

Streaming Growth and Churn

- There are more than 300 OTT providers in the USA alone. (LemonLight)

-

Entertainment and media will be worth $3.4 trillion globally by 2028. (PWC Global Entertainment and Media Outlook 2024-2028)

-

Digital platforms’ penetration expanded to between 84-85%, even as original content declined year-to-year during 2024 Q2. (MoffettNathanson Research)

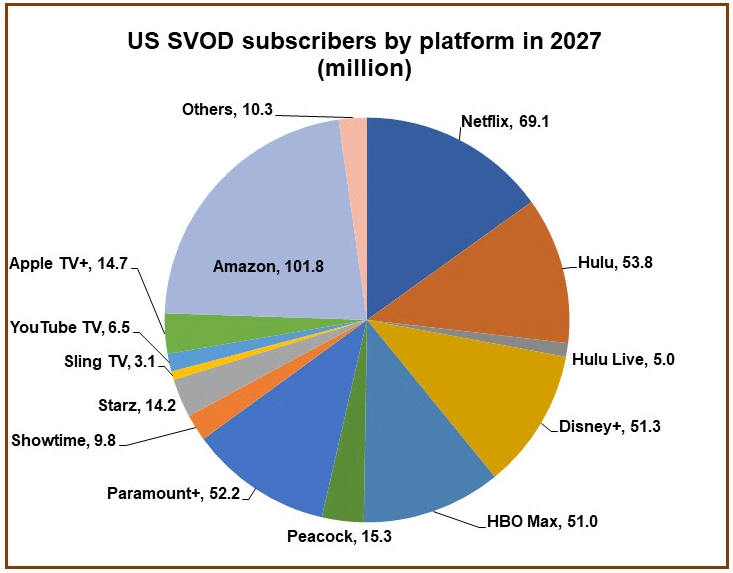

- U.S. to add 104 million SVOD Subs by 2027 (Digital TV Research)

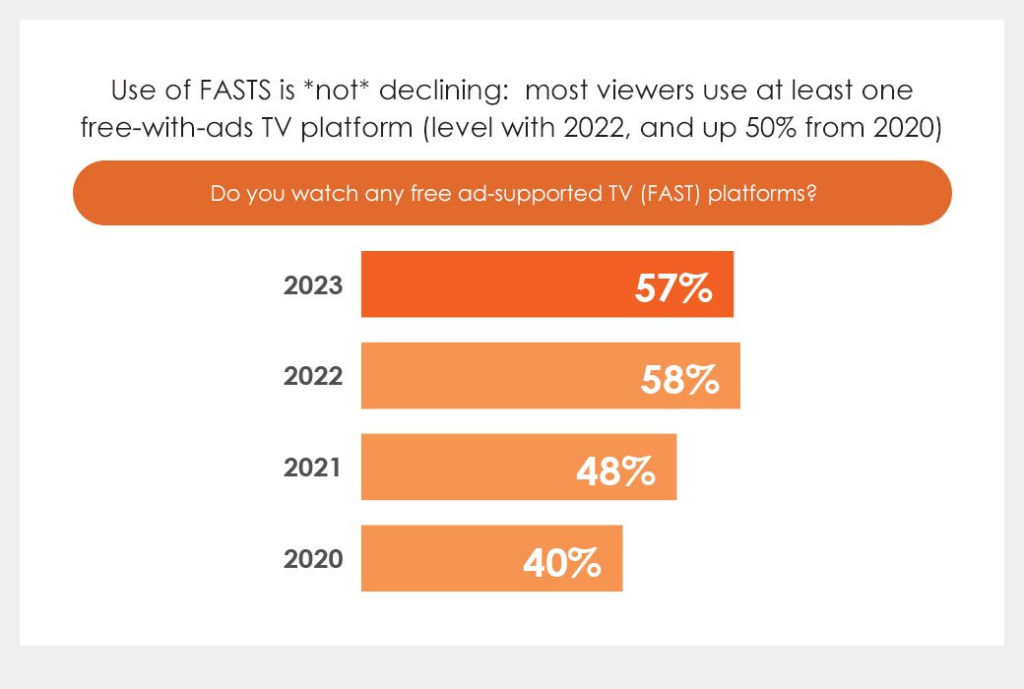

- After steep increases in consumption in 2021 and 2022, usage of the FAST alternatives remains strong in 2023. (Hub Entertainment Research, 2023)

- The U.S. market makes up around 80% of Free ad-supported streaming TV (FAST) revenue, which totals around $6.3 billion globally in 2023. (Source: Omdia, 2023)

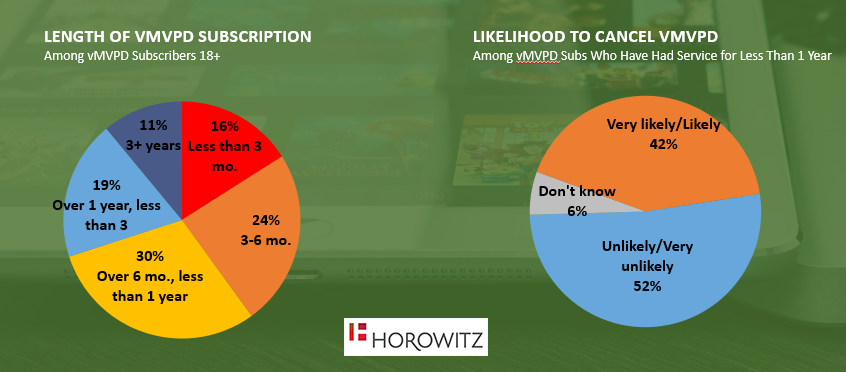

- However, the vMPVD market is also highly volatile with two-fifths (40%) of vMPVD subscribers subscribing for less than 6 months and 70% less than one year. In addition, 42% are very likely/likely to cancel in less than one year. (Horowitz Research)

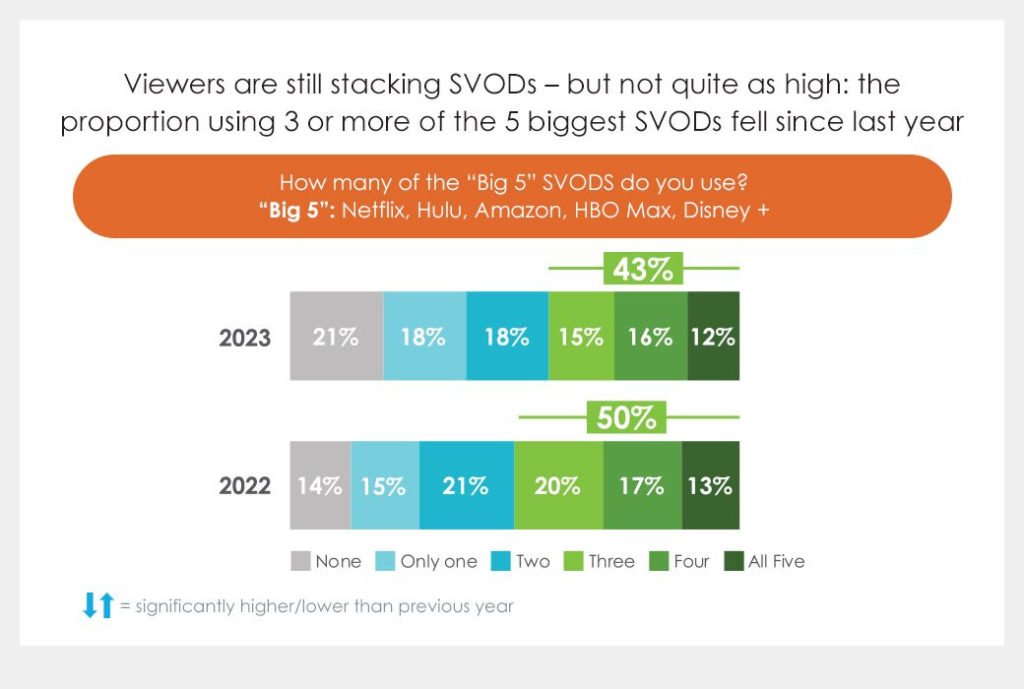

- For the first time, the “Big 5” SVOD services (Netflix, Prime Video, Hulu, Disney+ and Max) experienced a decline in subscribers since last year with fewer households opting to stack three or more. (Hub Entertainment Research, 2023)

- 35% of respondents say they would cancel Netflix over higher prices or password sharing crackdown translating into a loss of approximately 80 million subscribers. (Forbes Home, 2023)

- About 25% respondents say they would cancel any streaming service subscription if they cracked down on password sharing or over higher prices. (Forbes Home, 2023)

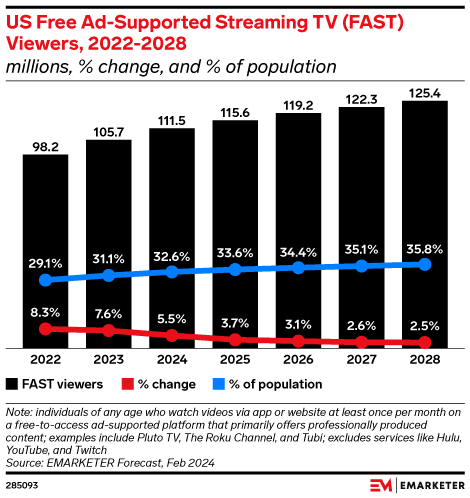

Aggregating Streaming Networks

- About 33% of the U.S. population and 44% of over-the-top video viewers will watch free ad-supported streaming television (FAST) in 2024. (E-Marketer, 2024)

- FAST channels are expected to see a 5.4% increase in viewership this year with The Roku Channel taking the lead. (E-Marketer, 2024)

- The number of unique FAST offerings are projected to increase this year, reaching 1,943. (Deadline, 2024)

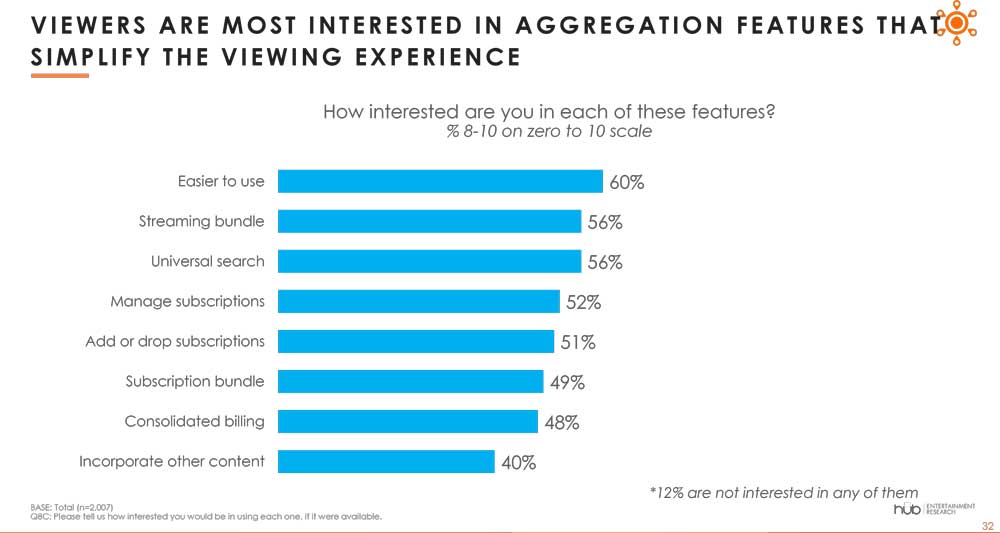

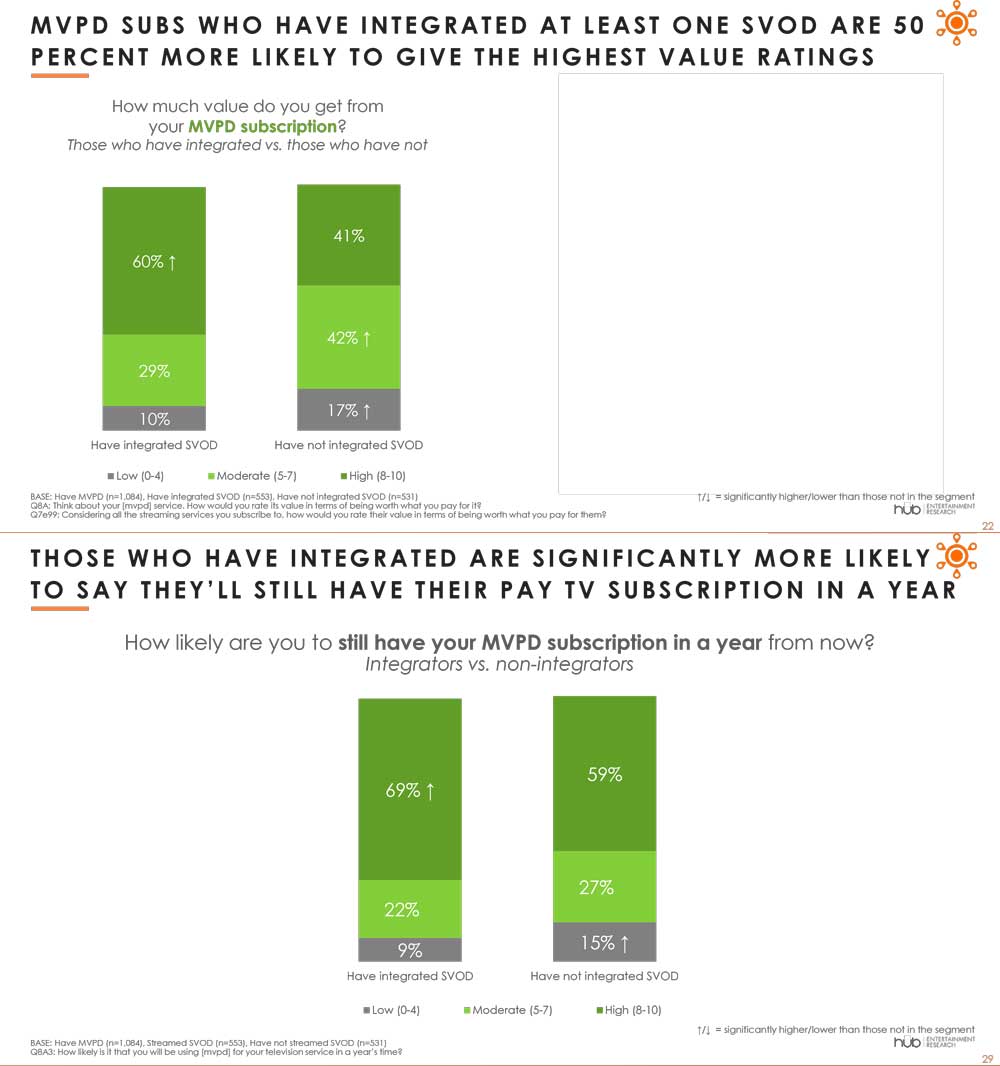

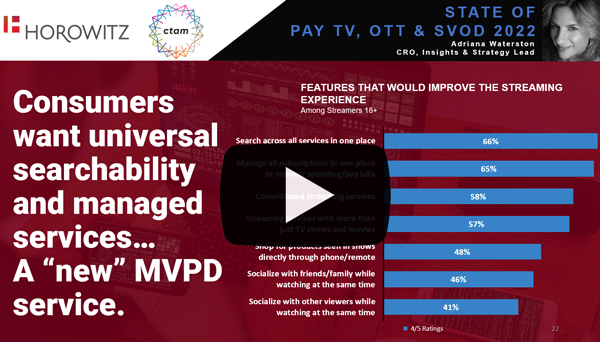

- Integrating SVOD and FAST streaming subscriptions into customer’s pay-TV services have the opportunity to increase value and renewal rates, with customers most interested in features that simplify their viewing experience. (CTAM/Hub Entertainment Research: Aggregation Study)

- Integrated SVOD Services Create Pay-TV Subscription Value: MSO subscribers with at least one SVOD service integrated into their TV service are 50% more likely to give high value ratings and report being more likely to still have pay-TV subscription in a year (69%). (Hub Entertainment Research Aggregation Study, 2023)

- Six in 10 (61%) streamers would be likely to switch to a bundle of subscription streaming services from one provider if this option were available. (Source: Horowitz – April 2023)

- 59% said that even with an additional charge, they would be willing to pay for an app that would allow them to manage, use, and pay for all of their subscriptions in one place. Source: Hub Entertainment Research, December 2023)

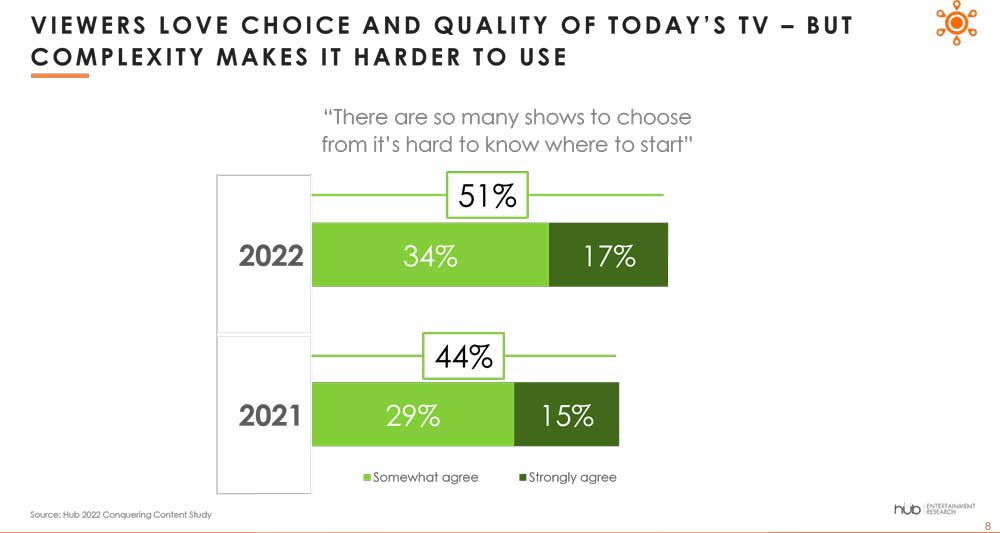

- Viewers Favor Choice and Quality in TV but Complexity Makes Choices Harder: Although consumers are attracted to the variety of choices and quality in TV options, over 51% reported “too many shows” making overall TV content choices harder to make. (Hub Entertainment Research Aggregation Study, 2023)

Streaming Behavior & Spend

- Three out of four (75%) of SVOD users are satisfied with their TV services. (MarketCast)

- The big screen (CTV – Connected TV) is now the primary way audiences consume streaming content. (Source: Comscore, State of Streaming)

- Almost two-thirds (65%) of TV HHs stream on a smart TV at least monthly. (Source: Hub Entertainment Research, Connected Home Study)

- 81% of SVOD streamers pick services based on cost with 40% of AVOD streamers citing low fees as a key benefit to AVOD. (Variety Intelligence Report and MRI, 2022)

- Nearly half (47%) of respondents pay for streaming services they don’t use. (Forbes Home, 2023)

- Only a small fraction (4%) ever review how much they’re spending on streaming services and half say they forgot to cancel a service after the offer of a free limited time subscription expired. (Forbes Home, 2023)

- A quarter of U.S. adults wait for streaming originals’ finale before starting, citing the following as reasons: (YouGov. 2023)

-

- A preference for binge-watching shows: 48%

- Fears over the show’s potential cancellation with an unresolved ending: 27%

- They do not want to wait for the next season after a cliffhanger: 24%

- 57% of subscribers signed up with a service to watch just one show, and more than half considered the opportunity to binge watch one show worth the price. (Forbes Home, 2023)

- Over one-quarter (27%) of streaming video services are shared and 12% of them are fully paid for by someone outside the household. (Leichtman Research Group, 2023)

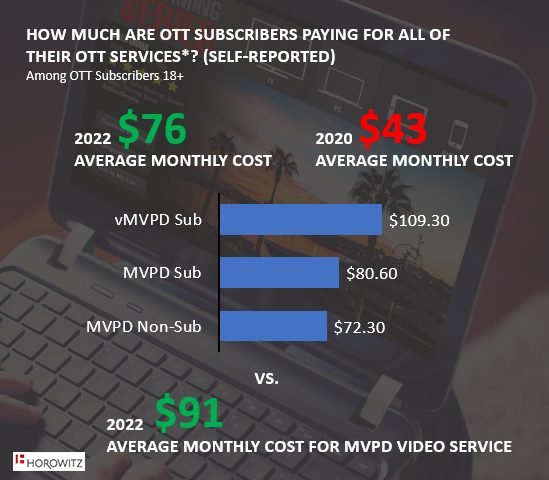

- The cost of overall OTT ($75 avg monthly cost) is approaching the cost of the MVPD video ($91). (Horowitz Research)

- Streaming audiences expect superior streaming quality with 22% of younger streamers saying they’ll abandon a show or movie if playback or buffering issues occur, stopping more users from streaming than ads (17%). (tubi+FOX, 2023)

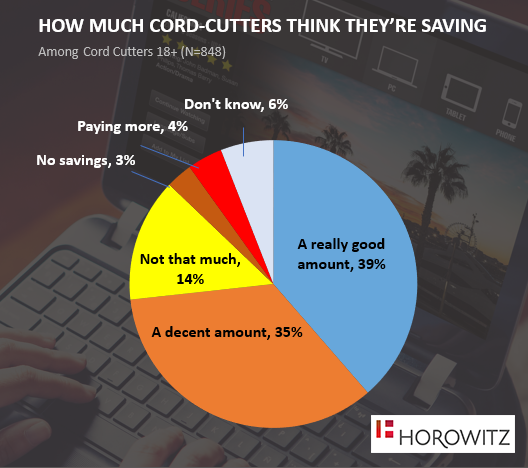

- Fewer cord-cutters feel they are saving “a really good amount of money” (39%). (Horowitz Research)

Advertising on Streaming Platforms

Ad Spending on Streaming

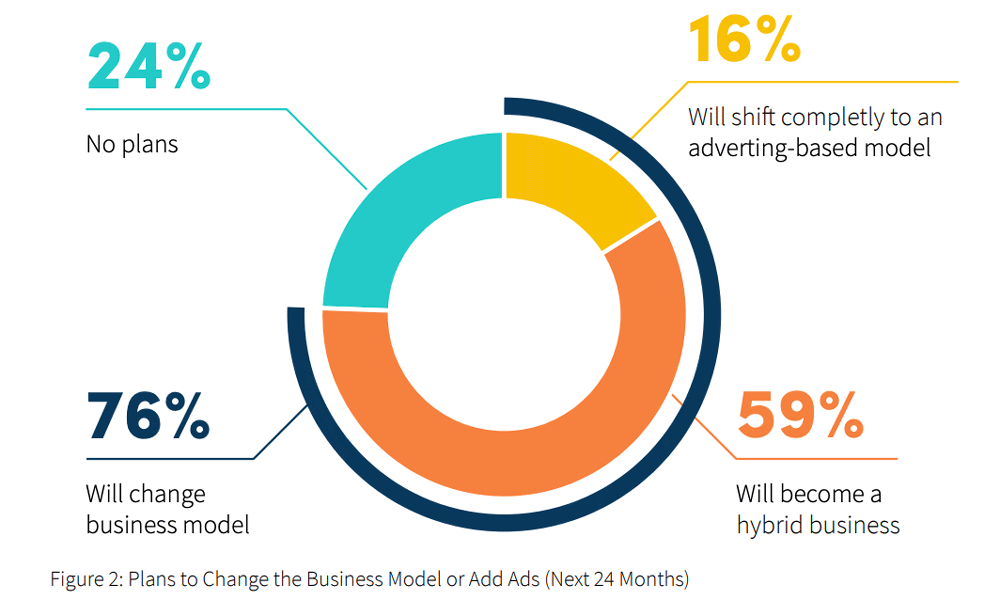

- By 2025, 76% of subscription streaming services that don’t currently have ad-based options will introduce them with 59% planning to implement a hybrid model in order to lower the price of subscriptions. (NPAW, 2023)

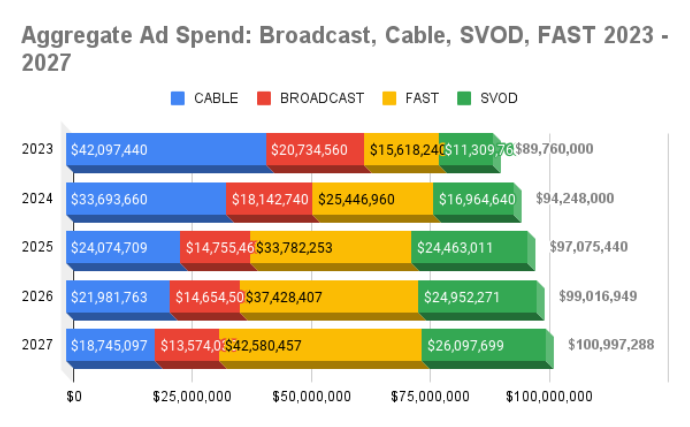

- FAST (free ad-supporting streaming TV) ad spend is projected to surpass that of cable, broadcast or SVOD services in ad spend by 2025. (TVREV, 2023)

- FAST will account for 68% of ad spending by 2027, or $69B of $101B. (TVREV, 2023)

- Ads will provide nearly 28% of streaming services’ revenue by 2028. (PWC Global Entertainment and Media Outlook 2024-2028)

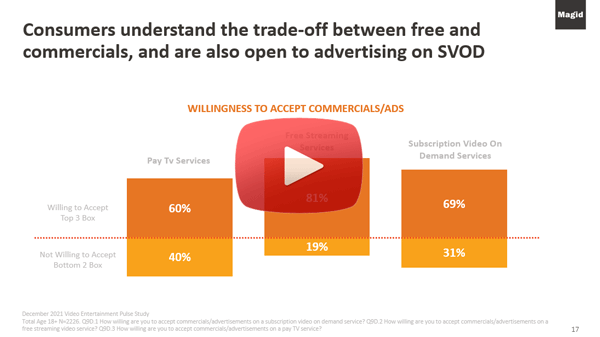

Consumer Streaming Ad Perceptions

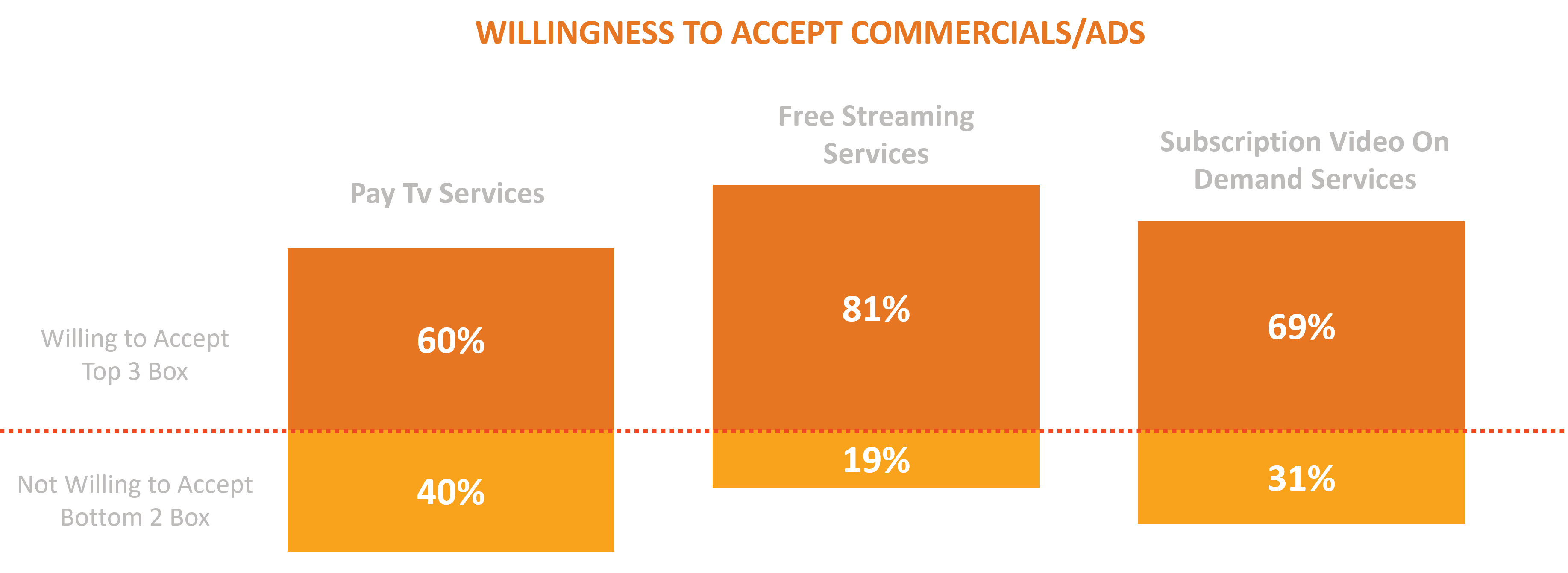

- Consumers understand the trade-off between free and commercials as 81% of free streaming service subscribers and 69% of SVOD subs are willing to accept commercials/ads. (Source: Magid’s Video Entertainment Pulse Study)

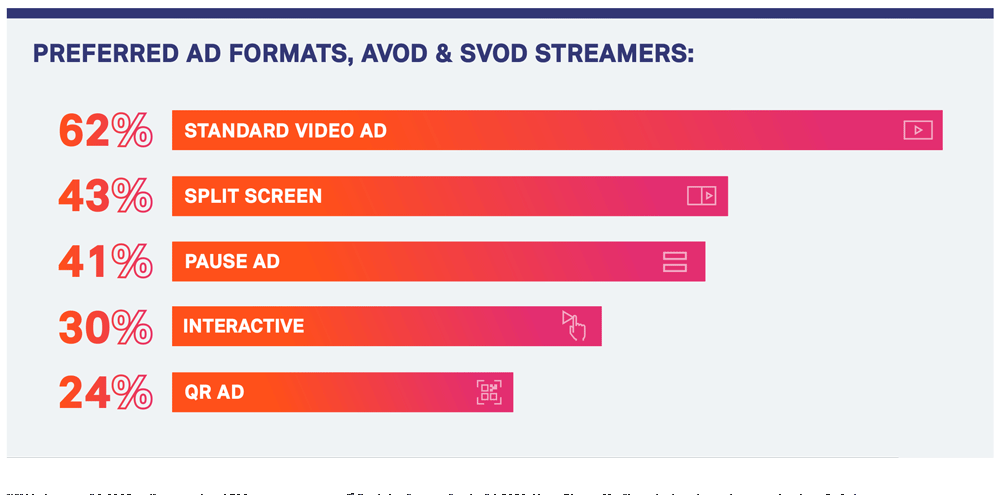

- 62% of AVOD & SVOD streamers prefer a standard video ad format. (tubi + FOX, 2023)

- 51% of streamers are satisfied with 6 minutes of ads per hour. (tubi+FOX, 2023)

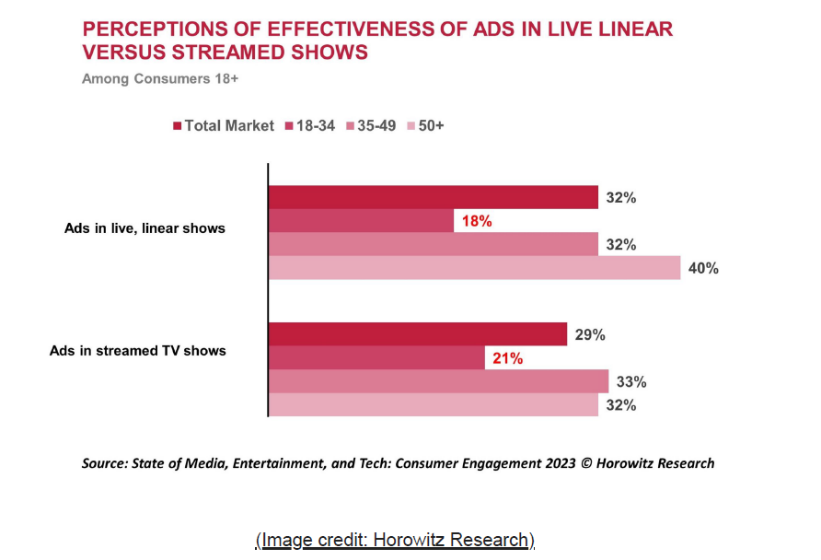

- Overall, 29% of adults 18+ perceived that streaming TV ads were effective compared to 32% of those for linear TV ads, with strongest perceptions of effectiveness among older adults for linear TV ads (40% for adults 50+ and 33% for adults 35-49 for streaming ads). (The State of Media, Entertainment, and Tech: Consumer Engagement– Horowitz Research, 2023)

- Not surprisingly, adults 18-23 and 35-49 are more likely than adults 50+ to find text messages, social media posts, influencer sponsorships, ads in podcasts, and ads in music streaming services much more effective. (The State of Media, Entertainment, and Tech: Consumer Engagement– Horowitz Research, 2023)

Streaming Types and Definitions

What is OTT?

“Over the top” (OTT) services refer to any type of video or streaming media that provides a viewer access to movies or TV shows by sending the media directly through the internet

*Collins English Dictionary

OTT Streaming Types and Examples

- SVOD = “subscription video-on-demand” in which a viewer sets up a monthly or yearly streaming subscription agreement for a flat monthly fee

- DTC = “direct-to-consumer” streaming service is when a network or streaming channel sells their service directly to the consumer bypassing retailers and wholesalers

- TVOD = “transactional video-on-demand”, which earn revenue via singular transactions “pay-per-view”

- AVOD = “advertising video-on-demand” services, which earn revenue from ads placed in streaming services

- FAST = “free ad-supported streaming TV services” are essentially live streaming services without the subscription and typically are an extension of traditional linear TV channels

*Please note that several streaming services can provide a hybrid model including subscription and advertising in their direct-to-consumer platforms.

Streaming Resources

Webcasts, Reports and Podcasts

The Impact of Aggregation

CTAM Commissioned Study with Hub Entertainment Research

June 2023

Discover how aggregating SVOD / FAST platforms into pay-TV services can impact perceived value, satisfaction, and likelihood to churn or recommend.

The Best Bundle

Hub Entertainment Research, April 2023

With signs of consumers’ insatiable appetite for more streaming finally plateauing, discover the role that bundles can play in a streaming world with more standalone options than ever.

CTAM Wired Webcast: FAST – Eroding Pay TV Engagement

There are two critical inflection points: when viewers discover free ad-supported streaming TV (FAST) and when they start using it daily. Both SVOD and TVOD engagement grows among these hyper users, but their linear TV viewership declines requiring a strategy shift. Discover the data behind these trends with examples of how to leverage FAST distribution to promote programming and increase content licensing revenue.

CTAM Wired Webcast – Culture, Content, and Competition: The Latest on the Latinx Video Market

Just in time for Hispanic Heritage Month, realize the power of cultural currency from the latest data and insights on the highly competitive market for video services among U.S. Latinx audiences. Discover which services are used the most and how streaming is impacting usage of and subscriptions to traditional MVPDs, as well as understand U.S. Latinx audiences’ content needs and how they feel about representation and inclusion in content and advertising.

The Stream: 2023 Audience Insights for Brands

tubi + FOX

Discover how Ad-Supported Video on Demand (AVOD) has become a part of the TV landscape and how the future of television is rapidly changing with consumer demand for how and what they want to watch. This report explores the options outside traditional pay-TV and the future outlook on ad-supported streaming.

The State of OTT Advertising in the U.S.

The accessibility and originality of over-the-top (OTT) content has become one of the many reasons for its popularity among consumers. Brands have seen the value of ad placements on these streaming platforms changing the OTT ad spend landscape. Discover the top OTT ad spending trends, analysis and advertisers in this OTT space.

Video Streaming Trends in the Era of “Peak Media”

Discover how media companies are finding success connecting with elusive audience segments to find new customers and manage churn volatility in the new streaming era with Universal Focus founder and Turner Broadcasting alum, NYU Stern Professor Paul Hardart.

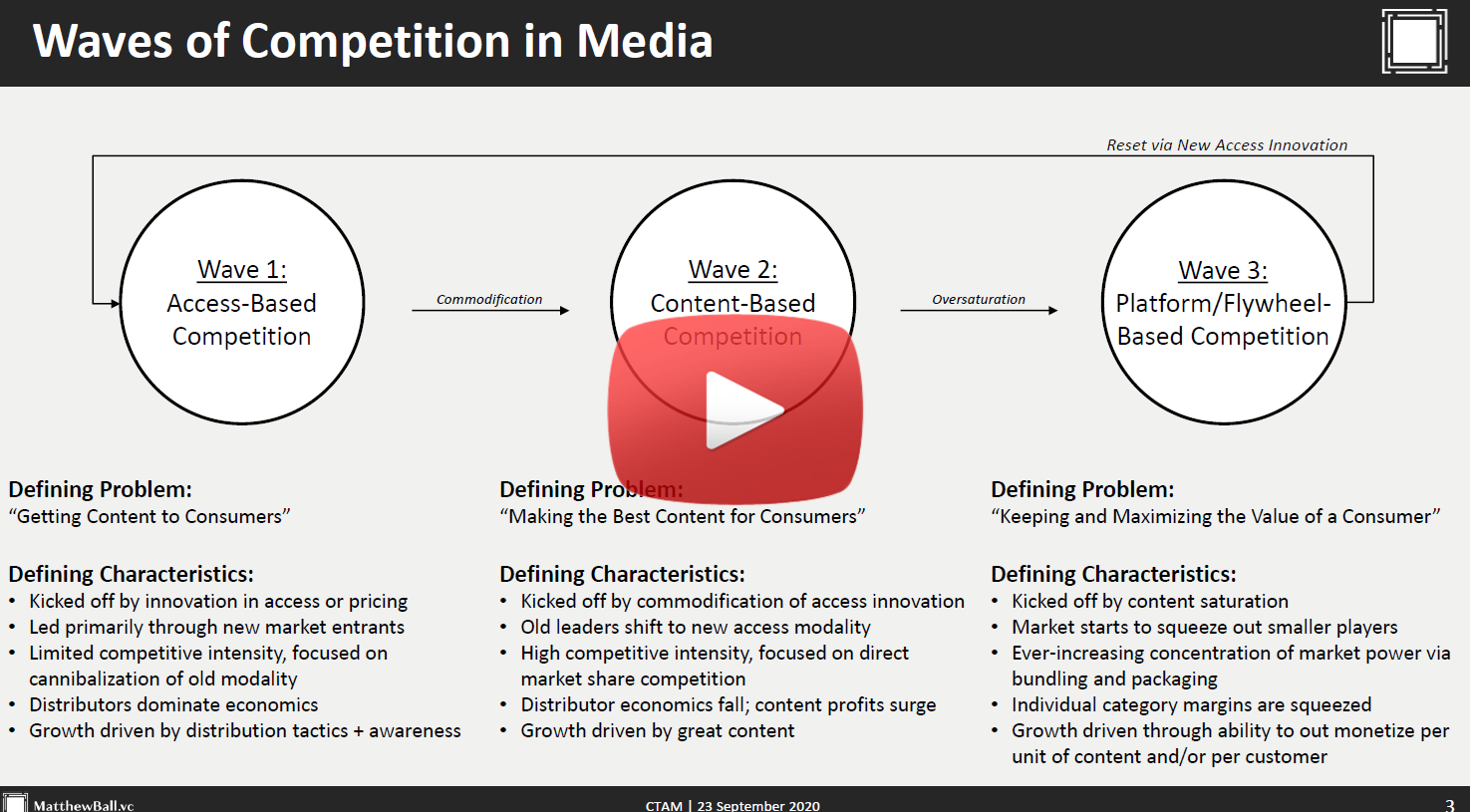

The Three Waves of Media Competition

Former head of global strategy at Amazon Video, Matthew Ball, discusses the wave of competition in media and asserts a shift toward using video to sell other things as the streaming “war” is mostly won through synergies and monetization elsewhere by monopolizing a consumer’s free time, spend and data.

The State of Pay-TV, SVOD, & OTT

(Horowitz Research)

Explore implications for the pay-TV business as viewing households sample various video subscription options and gain the latest insights revealing the impact that MVPD and OTT ecosystems have on subscriber satisfaction, viewing behaviors, and future plans.

Thinking Out Loud Episodes

Michael Wright: Succeeding in a Ruthlessly Competitive Business

What does it take to succeed in an over-saturated streaming world? According to guest Michael Wright, head of MGM+, it’s focusing on quantity, quality, and value. Michael asserts today’s sophisticated audience determines within five minutes whether they will keep a subscription after the free trial by quickly assessing three important things. Host Vicki Lins and guest Michael Wright discuss chasing people over profit, their recent acquisition by Amazon, and how Amazon’s resources and enthusiasm will guide awareness and subscriber growth.

Rebecca Glashow: Navigating The Steaming Wars With A New, Collaborative Roadmap

As the Streaming Wars evolved, we witnessed business models pull apart, sending parties to their respective corners, all trying to figure out what’s next. It became clear global scale is necessary to stay competitive, making co-productions a priority. Host Vicki Lins and guest Rebecca Glashow, CEO of Global Distribution for BBC Studios, discuss several topics including how through co-productions and partnerships, we are witnessing a resurgence of competitors also being colleagues, where working together can benefit individual businesses.

Redbox streaming into digital with 40 million loyal customers

For 20-years, Redbox has built a deep relationship with its 40 million customers. Their unique customer base, known for being late adopters of technology and 71% of them identifying as deal hunters, is devotedly following Redbox into a new world filled with endless entertainment options. In this conversation, host Vicki Lins explores how Redbox is almost effortlessly taking its customer base on a pilgrimage into the digital world. Galen Smith, CEO, Redbox, explains how their simplified, seamless process helps these late adopters shift to new offerings by the latest movies On Demand, free live TV channels, add supported On Demand and subscription channels all in one place.

David Smyth, Founder and CEO, YouLook: Not so FAST, AVOD’s Global Rise

As VOD consumption grows globally, media companies and entrepreneurs are recognizing a shift to AVOD allows content to reach a highly engaged audience, connecting both viewers and advertisers with a model that delivers more relevant ads and a better customer experience. David expands on his background as a TV executive at Sky Media and 20th Century Fox, his entrepreneurial vision for YouLook.tv, and shares insights about the market dynamics happening across the pond and how he intends to scale the business for long term success.

The Waves of Competition in Media

Former global Head of Strategy for Amazon Studios Matthew Ball forecasts the transitions facing media companies as new, OTT technologies, services and consumers have turned the tide of video streaming and steered the competitive direction of the industry. Discover how Amazon, AT&T, Comcast and more are going OTT to maximize consumer value and how the convergence of content and technology is expanding competition in media.