Streaming demand stays high, but rising costs and content overload are fueling a return to bundling. Explore CTAM’s top stats, trends, and forecasts shaping what’s next.

The Era of Re-bundling

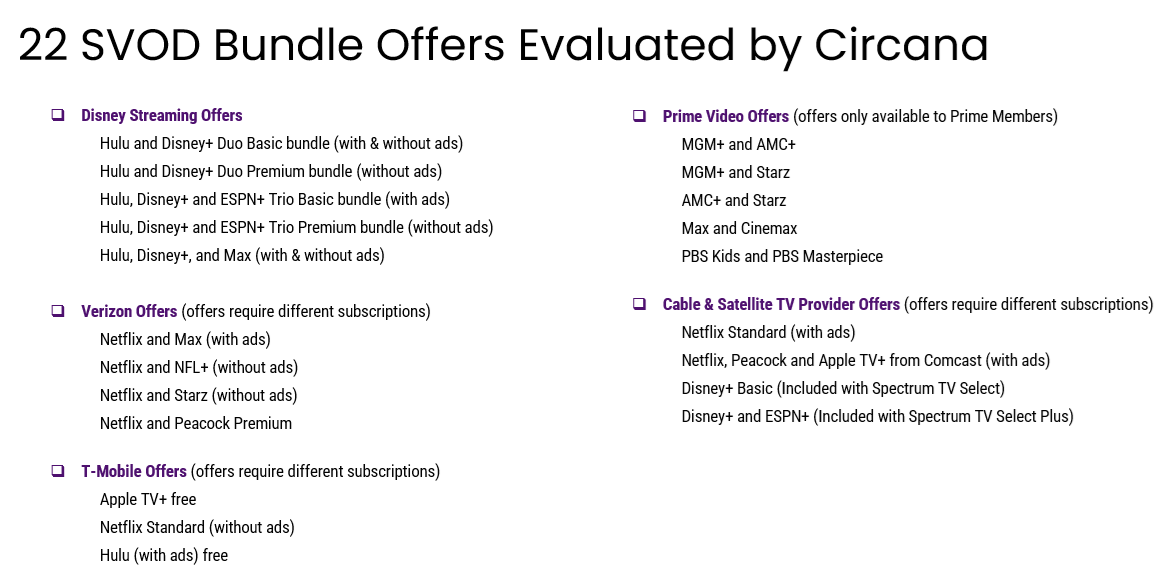

- According to Circana’s latest TV Switching Study, 2024 saw the return of the bundle:

- 14.2 million households reported cancelling an SVOD service after the TV series or movie they signed up for ended (Circana’s TV Switching Study, 2024)

- 23% of households already subscribe to one of the currently available discounted SVOD bundles above (Circana’s TV Switching Study, 2024)

- 25% of households say they are likely to sign up for one of the currently available discounted SVOD bundles above in the coming six months (Circana’s TV Switching Study, 2024)

Bundling Opportunities Go Beyond Video

High appeal exists for consumers in product, service & subscription bundles—particularly with Internet, retail, telecommunications and music products and services:

- At least six out of ten of consumers find mobile service (66%), retail membership (63%) or audio services (60%) to be the most important in bundle considerations followed by about half finding gaming (47%), home security (45%) and food delivery services (45%) important. (Content + Connectivity Consumer Insights, 2024)

- Rounding it out, education and learning services (40%), health and exercise (39%) and fantasy sports and gambling services (33%) are found to be the most important in bundle considerations. (Content + Connectivity Consumer Insights, 2024)

*Consumers that find this subscription type to be the most important in bundle considerations (2024)

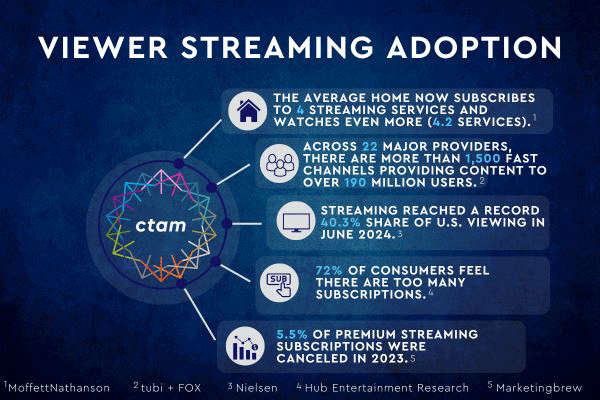

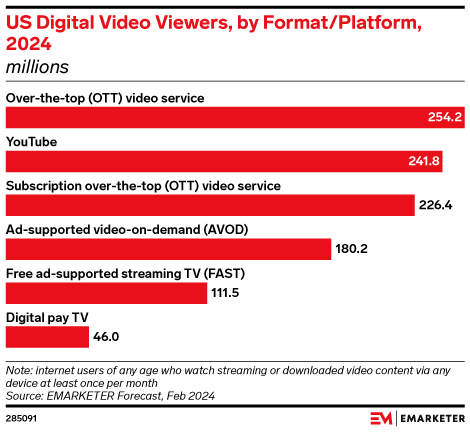

Streaming Adoption

- Almost two-thirds (66%) of streaming households now use ad-supported platforms, with Gen X and Boomers leading the shift. (Deloitte, October 2025)

- The launch of new streaming platforms in the U.S. and Canada slowed in 2024, with only 36 new services compared to 59 in 2023.

- The total number of available streaming platforms increased to 745, even as 40 platforms were discontinued, up from 27 in 2023. (BB Media Study, 2025)

- Over 254M (75% of the U.S. population) will watch OTT streaming services this year including SVOD, AVOD and FAST services. (e-Marketer, 2024)

- The number of global OTT service subscriptions is expected to increase from 1.6 billion in 2023 to 2.1 billion by 2028. (PWC, July 2024)

- The U.S. average number of streaming subscriptions per household is now at 5.1 — second globally overall only compared to India. (BB Media Study, 2025)

- Average Number of DTC Streaming Services by Age (Leichtman Research Group, 2023)

- A18-44: 4.8

- A45-54: 4.0

- A55+: 2.5

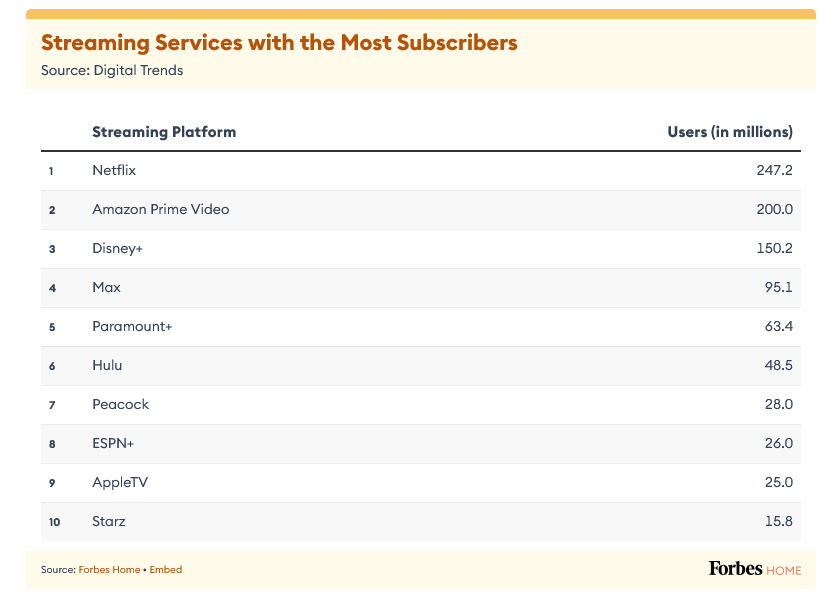

- Netflix is the streaming service with the most subscribers (247.2 million)* followed by Amazon Prime Video (200M) and Disney+ (150.2M) (Digital Trends, 2024)

*Note: Disney’s latest Q3 2024 number is 153.8M

The actual Q2 ending number reported in the trades is 277.6 for Netflix

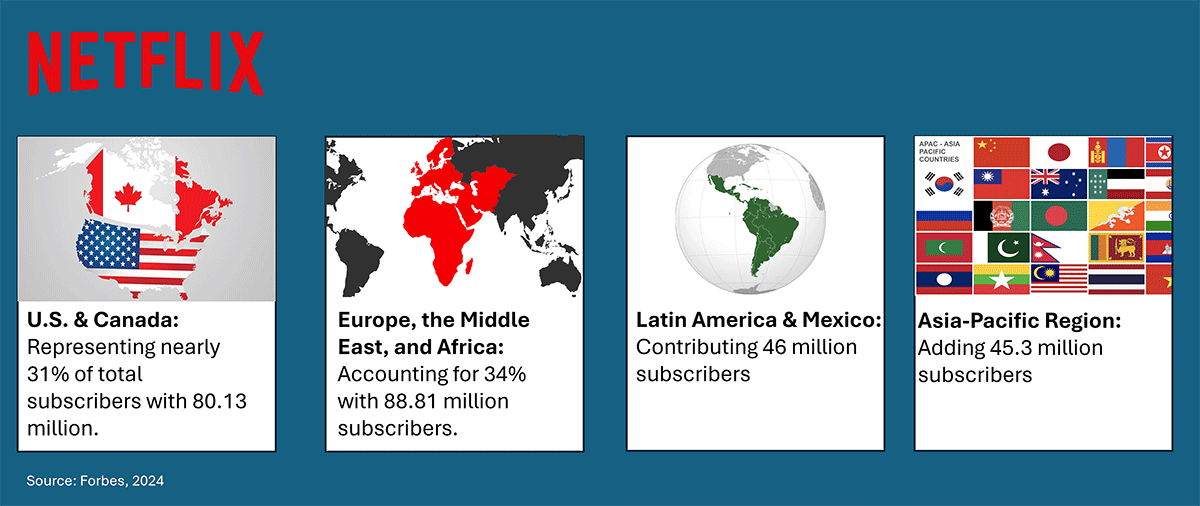

- Netflix is currently the most subscribed video streaming service, with 260.28 million subscribers worldwide. (Forbes, 2024)

- The increase in content across global SVOD services includes approximately 3,000 movies, 2,000 TV shows and 500 sports shows. (Gracenote, 2025)

- Overall, Amazon Prime Video remains the largest distributor of video content, offering nearly 69% of the available programming, up from 67.8% in Q1 2024. (Gracenote, 2025)

- Drama remains the top genre across the five services, but it has dropped from the No. 1 position on Disney+, where it has been overtaken by documentary, comedy, children and adventure.(Gracenote, 2025)

- 84% of consumers cite ease of content discovery as important for choosing to subscribe to a video/service provider. (CTAM, Magid Research, 2024)

- Over the past two years, fewer consumers (37% in 2025 vs. 41% in 2023) report signing up for a new service just to watch a specific show. (Hub Entertainment Research, Evolution of Video Branding, 2025)

- While 58% of consumers knew that Stranger Things is on Netflix, fewer could correctly identify where to watch shows like The Bear (Hulu), Game of Thrones (MAX) and Ted Lasso (Apple TV+). (Hub Entertainment Research, Evolution of Video Branding, 2025)

Streaming Costs & Churn

- 45% have canceled a streaming subscription within the last year because costs were too high. (Forbes, 2024)