As ad-supported streaming surges in viewership and revenue, platforms are prioritizing dynamic targeting, AI, and FAST to meet and exceed shifting consumer and industry demands. Explore CTAM’s curated stats, trends, and forecasts shaping the ad-supported market landscape.

FAST & AVOD Growth Trends

- Prime Video still leads in ad-tier usage, despite 14% Netflix increase (Deadline, January 2026)

-

The top 4 FAST services during the second half of 2025 were: Roku, Tubi, Pluto, and Prime Video. (Circana, TV Switching Study, 2026)

-

The rate of households using FAST leveled off during second half of 2025 at 69%. (Circana, TV Switching Study, 2026)

- Advertising Video on Demand (AVOD) spending expected to rise by 17% due to increased revenue, specifically from Prime Video, Netflix, and FAST networks fueling the total advertising-supported streaming marketplace. (MediaPost, October 2025; Moffett Nathanson Research)

- Over $15 billion projected to be spent on 11 platforms in 2025.

- Revenue spikes include The Roku Channel (22%) and Tubi (24%), with Hulu leading the pack, and Prime and Netflix gaining.

- Streamers reduce 2025 linear media spending by 48% while NFL and College Football linear ad spending increased by 4% in Q3 2025. (MediaPost, October 2025; EDO Ad Engage / iSpot)

- 50% of poll participants who are professionals in film and TV highlighted effective media placement strategies as the most impactful factor in reducing churn. (Looper Insights: Streaming Forward: Trends Shaping Digital Entertainment in 2025)

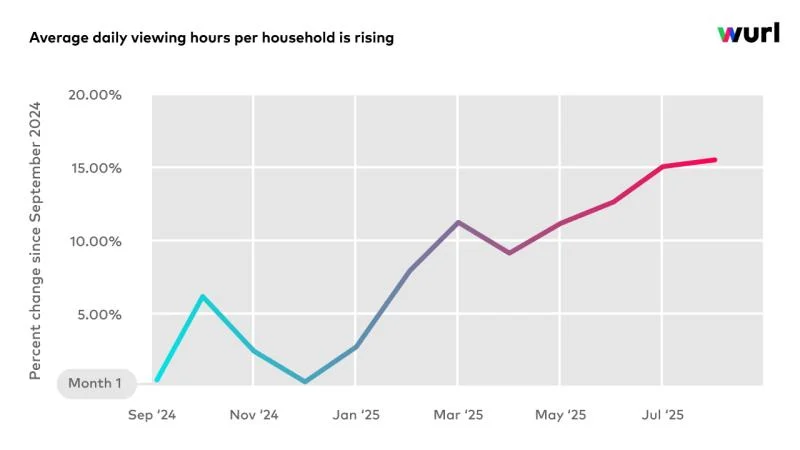

- The number of “monthly active households” using free ad-supported streaming TV services was up 12% YoY as of August, while the average daily FAST viewing hours per household climbed 16% YoY. (Wurl CTV Trends Report, 2025)

- The increase in average daily households as well as hours of viewership per household resulted in a nearly 29% boost in total HOV across ad-supported streaming channels over the past 12 months. (Wurl CTV Trends Report, 2025)

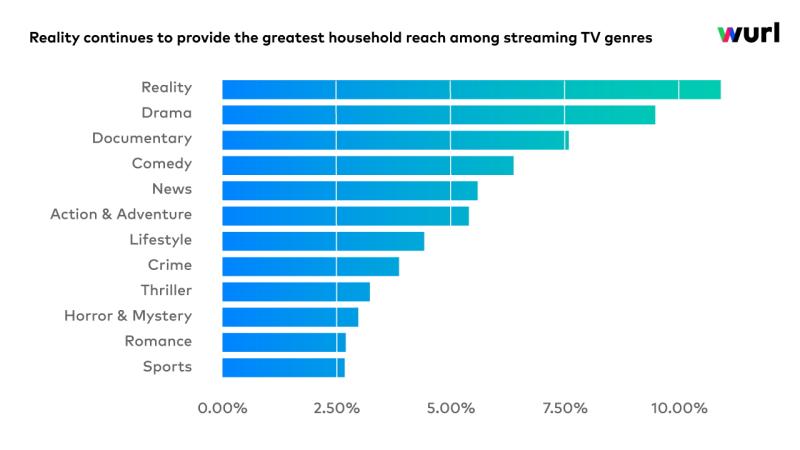

- Among programming genres, reality programming garners the biggest share of FAST viewing time, consuming nearly 11% of aggregate usage. (Wurl CTV Trends Report, 2025)

- Documentaries and drama provide the greatest amount of FAST content, while news is increasing most rapidly. (Gracenote, August 2025)

- The number of unique FAST offerings are projected to increase this year, reaching 1,943 channels. (Deadline, 2024)

- Free ad-supported TV (FAST) channels like Pluto TV, Roku Channel and Tubi accounted for 4.3% of streaming, beating out Peacock, Max, and Paramount+, which totaled 3.7%. (Nielsen, 2024)

Ad Spending on Streaming Platforms

- Ads will provide nearly 28% of streaming services’ revenue by 2028. (PWC Global Entertainment and Media Outlook 2024-2028)

- Premium streaming platforms increased ad revenues by almost 50% year-to-year during the third quarter in 2024, reaching $3.8 billion. (MoffettNathanson, Q3 2024 Analysis)

Top Performers in Q3: MoffettNathanson, Q3 2024 Analysis

- Hulu: $782M (+5%)

- Peacock: $761M (+114%)

- Prime Video: $441M (+230%)

- Netflix: $429M (+95%)

- Roku Channel: $331M (+22%)

- Pluto TV: $272M (+18%)

- Tubi: $255M (+19%)

- Disney+: $141M (+180%)

Top Earners for 2024: MoffettNathanson, Q3 2024 Analysis

- Hulu: $3.1 billion

- Peacock: $2.1 billion

- Prime Video: $2.0 billion

- Netflix: $1.6 billion

- Roku Channel: $1.2 billion

- Pluto TV: $1 billion

Biggest Growth Platforms in 2024: MoffettNathanson, Q3 2024 Analysis

- Disney+: +261% to $531M

- Prime Video: +133% to $2.0B

- Netflix: +116% to $1.6B

- For the 11 top premium streamers, 2024 revenue estimates for AVOD platforms are projected to grow 39% to $14.3 billion. (MoffettNathanson, Q3 2024 Analysis)

- Notably, political advertising significantly boosted revenue for platforms like Max, Discovery+, Tubi, Pluto, and Roku. (MoffettNathanson, Q3 2024 Analysis)

Streamers tap diverse revenue models as AVOD grows

(TVNewsCheck, 2025)

- The global AVOD market is projected to grow to $69 billion by 2027, up from $38 billion in 2023 (Statista, 2024)

- 70% of consumers consider payment options when making purchasing decisions (PYMNTS, 2024)

- Full Story: TVNewsCheck (free registration) (TVNewsCheck, 2025)

Consumer Streaming Ad Perceptions

-

Potential FAST churn during the second half of 2025 reached the highest in two years at 4% and was most pronounced among users aged 35–54 at 5%. (Circana, TV Switching Study, 2026)

-

Viewers aged 18-34 expressed the greatest likelihood at 8.6% to start using new FAST services. (Circana, TV Switching Study, 2026)

-

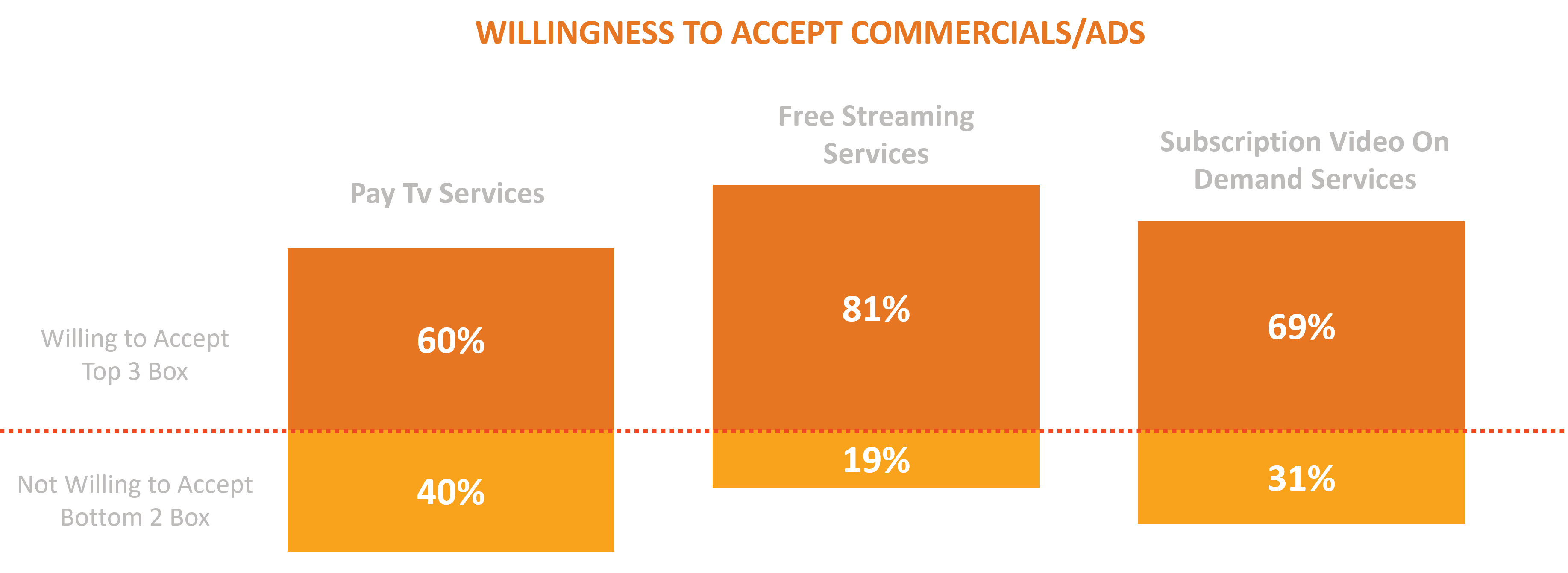

Consumers understand the trade-off between free and commercials as 81% of free streaming service subscribers and 69% of SVOD subs are willing to accept commercials/ads. (Source: Magid’s Video Entertainment Pulse Study)

- 50% of streaming users pay for a streaming service without ads, with 24% reporting that they specifically pay to avoid ads and prefer an uninterrupted viewing experience. (Forbes, 2024)

- 26% are unsure whether their subscriptions include ads or not, suggesting a degree of ambiguity or indifference towards the presence of ads in streaming content. (Forbes, 2024)